The cost of living is rising, prompting many people to look for ways to reduce expenses. As it becomes more expensive to buy and hire vehicles and keep a car on the road, this guide contains useful tips to help you save.

Finding the best deals on new and used cars

Most drivers change vehicles on a regular basis. Buying on finance and taking out long-term lease agreements have become more popular in the last decade. When you swap cars every 2-5 years, finding the best deals is essential. If you are approaching the end of a contract, or you’ve decided to replace a vehicle you own, it’s wise to take the time to compare offers, get quotes and see what kinds of deals are out there.

Researching online is useful but it’s crucial to be aware that prices fluctuate and vary. If you’re thinking about leasing a car for a three or five-year period, for example, prices you see online will often reflect a set mileage per year and a standard model. If you want to add extras, upgrade to a sportier version or increase the annual mileage allowance, the cost will increase. You can get quotes online but it’s beneficial to visit dealerships and get written breakdowns before you decide which vehicle to buy or hire and which company to buy from.

Consumers today have a huge range of choices, in terms of where you buy or lease cars from. Many people still prefer to go into a dealership or visit showrooms to get an idea of what is available, but it can also be beneficial to use the Internet to compare offers. Manufacturers may be running promotions, such as deposit contributions, which could save you money, or you might find that some dealers offer better value for money than others. Once you’ve got full, written quotes in front of you, go through the details, read the small print and figure out which offer suits you best.

Reducing running costs

The cost of living is rising, which is pushing prices up for drivers. Fuel costs have soared in the last twelve months and companies that operate within the auto industry have increased prices. This means that customers may be paying more for services, repairs, breakdown and recovery and insurance. Running a car is expensive at the moment, but there are ways to save.

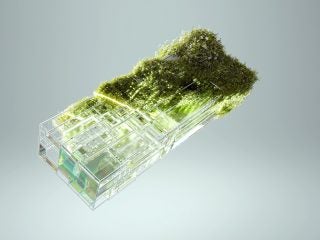

One option for drivers who want to save money in the long term and reduce carbon emissions is to explore the possibility of switching to an electric or hybrid vehicle. The initial layout is likely to be higher, but running costs will decrease immediately. The cost of charging a car is significantly lower than filling up a tank. Hybrid and electric vehicles are also more environmentally friendly, which saves money on taxes and emissions charges in many countries and large cities.

Maintenance is another important point for drivers to consider. Car repairs can be incredibly expensive, especially if you don’t have breakdown cover or a warranty. If you’re buying a car, it is advantageous to explore service plans and think about taking out an extended warranty. You can research companies and find useful information such as a review of CarShield and customer testimonials online. It’s also essential to keep up with routine services and get any minor issues checked out. Small problems can spiral into big issues, which are expensive to fix.

Saving on insurance

Car insurance is one of the most significant expenses for drivers. In Canada, the average customer pays between $1,300 and $1,800 per year. The cost of auto insurance varies hugely, according to the make and model, the age and condition of the vehicle and the age of the driver. If you have made a claim in the past, or you live in an area where crime rates are higher than the national average, you may also find that your premium costs more. To save money on car insurance, it’s a brilliant idea to compare prices online before you buy. If you have a policy that is due to expire, resist the temptation to accept the renewal quote to save time and effort. Use a comparison site to see what else is out there. You may be surprised at how much you could save by switching to a different provider. Insurance companies often reserve their best offers for new customers, which means that changing your policy may work out cheaper than rolling an existing policy over. If you own more than one car, get a quote for multi-vehicle insurance. Some providers also offer discounts for drivers who have a black box in their cars.

Preserving vehicle value

If you own your car, it’s wise to try to protect your investment. When it comes to selling, you want to achieve the best price possible. Most cars lose value over the course of time but there are certain factors that influence the rate of deterioration. To preserve the value of your vehicle, take good care of the car. Keep up to date with services and tests, clean the vehicle regularly and seek advice if you have concerns. Limit mileage where possible and drive carefully. If your car is in good condition, it has a full service record and it looks well cared for, you can reduce the risk of it losing value and increase its saleability. If you decide to sell, get several quotes and research online to give you an idea of how much the vehicle is worth. Be prepared to negotiate.

Fuel costs are going up at a time when the cost of living is rising. Many drivers are feeling the squeeze. If you’re looking for a new car, or your hire contract is coming to an end, there are ways to save. Shop around for the best offers and deals and compare quotes before you decide which car to buy or hire and which company to buy from. Compare insurance costs, keep up with routine checks and services and explore service plans and warranties. Look after your car to preserve value.